#401k rollover to gold

Explore tagged Tumblr posts

Video

youtube

FDIC Lied About Banks on Purpose | Exposing Policy Lies and Hidden Agend...

You better pay attention here. Your future depends on it.

0 notes

Text

instagram

#financialsuccess#retirementsavings#account#missingmoney#gold 401k rollover#howtorollover#good financial planning#Instagram

8 notes

·

View notes

Text

Gold Investing and Retirement

Investing in gold as a hedge against inflation is a great idea in a high inflation economy, and times of stock bear market and declining dollar.

Unfortunately right now it looks like we are going through all 3 at the same time. We give information on how using gold and other precious medals can hedge your investments against inflation as well as preserve them for your retirement.

Explore our channel and learn how to invest in gold, or start or rollover an existing 401k or other plan into a Gold IRA or other precious metals IRA.

#gold IRA#buy gold#best gold IRA#gold IRA companies#best gold IRA company#best gold ira company reviews#best company to rollover ira to gold#401k to gold IRA rollover#best gold investment companies. Augusta Precious Metals Review

2 notes

·

View notes

Text

youtube

#Required Minimum Distributions#death and taxes#us taxes#ira#roth#pottlewealth#retirement#401k#gold 401k rollover#403b#finance#Youtube

0 notes

Text

Sign up for Robinhood with my link and we'll both pick our own gift stock 🎁 https://join.robinhood.com/rondak35

https://join.robinhood.com/rondak35

I have been with Robinhood for almost 4 years, as a rookie investor for 2 and I started banking with them about 2 years ago when they officially started banking!! they also let you buy and sell crypto and offer 401k etc it's a really cool platform user friendly and will teach you from the bottom up if you want to invest they'll even give you pointers on what stocks are good to buy and which aren't etc

I highly recommend Robinhood!

#crypto#banking#aitomaticdeposit#brockerage#transfers#freestock#robin hood#stocks#ira#gold 401k rollover

0 notes

Text

Gold often behaves differently than stocks and bonds, so adding it to your retirement portfolio can help spread risk and potentially improve overall stability. There are basically two options: direct and indirect rollovers. A direct rollover involves the transfer of funds directly from your old 401(k) to your new self-directed gold IRA. Gold held within a retirement account can be passed down to beneficiaries upon your death, providing a way to transfer wealth to future generations in a tax-efficient manner. 401K to Gold IRA Rollover.

0 notes

Video

youtube

Important Things To Know About Gold IRA Rollover Investments

Despite the fact that the races are finally finished, most would agree an economic 'frankenstorm' is approaching. As a matter of fact, if you discuss these issues to your companions, you are probably going to find that many are worried about their click here to learn more positions, retirement accounts, and the capacity to get the essential necessities of life.

Unfortunately, going to the news will in general make everybody much more anxious about what's in store. This is simply of many reasons why individuals are going to precious metals and gold IRA rollover accounts- - to fight off guaranteed catastrophe. If you haven't caught wind of gold-supported investing, this is a great opportunity to learn more.

Did You Lose Your Employment over the Most recent 60 Days, or Going to Lose it?

As you might know, various organizations are now laying off workers to try not to need to spend more cash on health care coverage inclusion. Obviously, this will put a colossal measure of downward tension on customer certainty during the Christmas season. Curiously, after you lose an employment, you have a multi day window to move your retirement account to another holder.

If you move to a precious metals IRA, you won't have to go through a business. All things being equal, you can work with an autonomous gold-supported IRA agent to set up the account and direct it. Beside protecting your ongoing investment, you won't need to suffer any consequences to make this exchange. People that suspect they will lose their employment can likewise invest in a precious metal or gold IRA and partake in a similar degree of security.

Regarding Retirement Investment accounts Being Cleared out

Do you remember the day you went to work and figured out the worth of your IRA had plunged to 60% or less of its worth from the other day? Chances are, you were in shock to find out you had been robbed of your life reserve funds surprisingly fast.

Unfortunately, as the days wore on, you additionally figured out that there was no getting that cash back without attempting to invest in hazardous paper showcases that were ill-fated to fail similarly as much as the "blue stocks". On the other hand, you may likewise have seen that portions of your 401k devoted to precious metals endure the surge and kept on acquiring in esteem even as the worldwide economy kept on going to pieces.

7 notes

·

View notes

Text

#gold#silver#silver collectibles#silver rings#401k rollover to gold#silverbullion#move 401k to gold#move 401k or ira to gold

0 notes

Video

youtube

How To Lay out A Gold IRA

Precious metals, basically gold and silver, provide great portfolio diversification as well as a fence against market instability and inflation. Turning over a current 401k into a gold IRA has turned into a famous approach to both invest in physical read more here precious metals as well as plan for a safer retirement. So this has yet to be addressed: how can one lay out an IRA gold investment?

Adding physical precious metals to an IRA, first turned into an option in contrast to conventional 401k's following the formation of the Tax Payer Relief Demonstration of 1997. Reasonable metals in a gold IRA include gold, silver, platinum, and palladium, which must all be bullion coins or bars and of specific specified fineness. Uncommon coins and other collectable gold and silver coins are not passable in a gold IRA. Your precious metals agent will actually want to work with you and prompt you on which metals are ideal for your portfolio.

Prior to settling on a choice on which metals to buy for your Personally managed IRA, it is insightful to initially start the most common way of laying out an IRA. The best spot to begin is to have your precious metals representative contact your ongoing caretaker to find out if you can add physical metals to your ongoing IRA. Generally speaking, specific IRA plans and certain rules with your ongoing account won't allow for precious metals investments. You should then begin the course of a 401k rollover into a new, gold IRA account.

Your representative will then, at that point, help you select a caretaker who has some expertise in managing gold Ira's. When chosen, some desk work should be finished up, which includes the sum you will be moving into the new gold IRA account, any recipients to be included on the account, alongside some additional standard data.

An IRA gold investment arrangement for the most part takes somewhere in the range of 3-5 business days following the commencement of the cycle. When this is finished, the time has come to choose and put the metals into your IRA account! Remember, there are just sure items that are passable in an IRA, which your dealer ought to be all ready to provide to you.

2 notes

·

View notes

Text

youtube

🥇🥇Get a Free Gold Guide Now From Noble Gold Investments🥇🥇 http://www.NobleGoldInfo.com Why Noble Gold Investments? 🌟 Highest Customer Satisfaction Ratings 🌟 Exclusive secure storage in TEXAS 🌟 $20,000 Minimum for Gold IRAs/$10,000 min Cash Purchase 🌟 Gold, Silver, Platinum & Palladium all available! EASY to get started! Visit: http://www.NobleGoldInfo.com Disclosure: This website contains affiliate links. When you click on these links and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers.The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its own risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns. If you're considering investing in a Gold IRA, it's essential to choose a reputable and trustworthy company that will prioritize your financial well-being. That's where Noble Gold Investments comes in. With their exceptional track record and commitment to customer satisfaction, it's clear why they stand out in the industry. One of the primary reasons to choose a Gold IRA with Noble Gold Investments is their solid reputation. With an A+ rating from the Better Business Bureau (BBB), Noble Gold has proven their commitment to integrity and ethical business practices. This accreditation serves as a testament to the trustworthiness and reliability of the company. Another crucial aspect to consider when selecting a Gold IRA provider is the fees associated with the account. With Noble Gold Investments, you can expect transparent and competitive fees. They believe in putting their clients first and ensuring that their investments are maximized. By offering fair and reasonable fees, Noble Gold Investments allows you to keep more of your hard-earned money working for you. When it comes to researching and choosing a Gold IRA provider, having access to accurate and up-to-date information is key. Noble Gold Investments understands this and provides an informative and user-friendly website. Their website serves as a valuable resource for potential investors, offering a wealth of information about the company, the gold market, and the process of opening a Gold IRA. This transparency and accessibility demonstrate Noble Gold Investments' commitment to empowering their clients with the knowledge they need to make informed investment decisions. Additionally, Noble Gold Investments has established itself as a reputable company within the precious metals industry. With a strong presence and a focus on gold bars, Noble Gold Investments is well-positioned to guide investors towards a secure and successful investment. Their expertise and knowledge of the market make them a trusted partner for savvy investors looking to diversify their portfolios. Overall, when considering a Gold IRA, it's crucial to choose a provider that offers a solid reputation, competitive fees, transparent information, and expertise in the field. Noble Gold Investments checks all of these boxes, making them a top choice for investors seeking to safeguard their wealth through a Noble Gold IRA. #noblegoldinvestmentsreview #goldira #goldinvestment #401krollover #retirementpreparation Noble Gold Investments | Noble Gold Investments Review #noblegoldinvestmentsreview published first on https://www.youtube.com/@goldinvestingandretirement9337/

#best company to rollover ira to gold#401k to gold IRA rollover#best gold investment companies. Augusta Precious Metals Review#Youtube

0 notes

Text

Gold 401k Rollover: Secure Your Retirement with Precious Metals | IRA Gold Proof

A Gold 401k Rollover allows you to protect your retirement savings by transferring your existing 401k into a gold-backed IRA. Discover how this strategy can safeguard your wealth against inflation and market volatility. Learn the benefits and process of a Gold 401k Rollover with IRA Gold Proof.

0 notes

Text

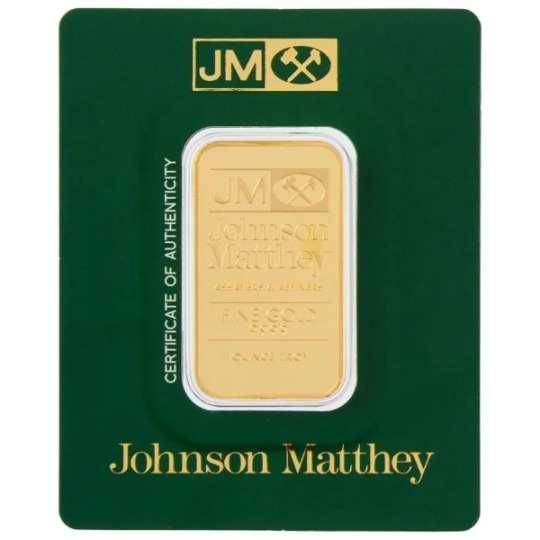

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

youtube

Choosing the Best Gold IRA Company to Rollover Your 401k https://www.youtube.com/watch?v=NydvLtZp5ig 401k to Gold: How to Choose the Best Gold IRA Company The post Choosing the Best Gold IRA Company to Rollover Your 401k appeared first on My IM Place EMBEDATOR. from Embedator https://embedator.myimplace.com/choosing-the-best-gold-ira-company-to-rollover-your-401k/

0 notes

Text

youtube

🌟��Top Gold IRA Companies🌟🌟 🌟🌟Updated, and current list🌟🌟 #1 : Noble Gold Investments: Minimum Investment: $20,000. Get the Guide: ➡️ http://www.NobleGoldInfo.comBullion Only - Texas Storage available! biggest bang for the buck! #2: GoldenCrest Metals: Minimum Investment: $10,000. Get the Guide: ➡️http://www.goldencrest.info #3: Augusta Precious Metals: Minimum Investment: $50,000. Get the Guide: ➡️http://www.easygoldinvestments.com #4: Birch Gold Group: Minimum Investment: $10,000. et the Guide: ➡️http://www.GoldForTheFuture.comWide selection of metals and options! See the FULL List and updates and more information on Gold: ➡️http://www.GiveMeTheGold.com Rolling Over a 401k to a Gold IRA | GiveMeTheGold.com podcast brief #401ktogoldirarollover published first on https://www.youtube.com/@goldinvestingandretirement9337/

#best company to rollover ira to gold#401k to gold IRA rollover#best gold investment companies. Augusta Precious Metals Review#Youtube

0 notes